UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

| 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087 | ||

April 8, 2025

Dear Stockholder:

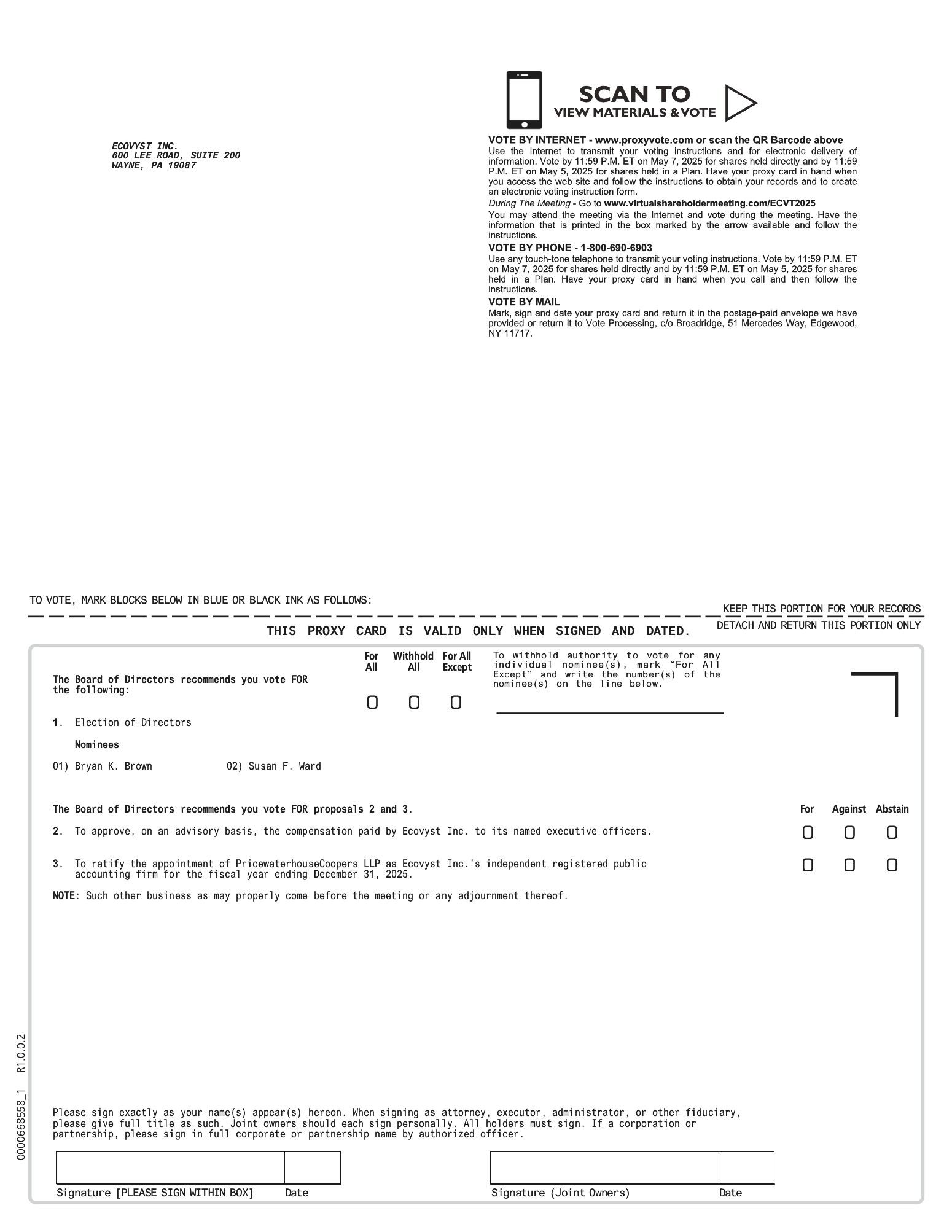

We cordially invite you to attend our 2025 Annual Meeting of Stockholders on Thursday, May 8, 2025 at 8:30 a.m. (Eastern Time), to be conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ECVT2025.

The proxy statement accompanying this letter describes the business we will consider at the annual meeting. Your vote is important regardless of the number of shares you own. Whether or not you plan to attend the annual meeting, we encourage you to consider the matters presented in the proxy statement and vote as soon as possible. Instructions for Internet and telephone voting are attached to your proxy card. If you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosed envelope.

We hope that you will be able to join us on May 8th.

Sincerely,

Kurt J. Bitting

Director and Chief Executive Officer

2025 PROXY STATEMENT |  | ||

| 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087 | ||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2025 Annual Meeting of Stockholders (the “Annual Meeting”) of Ecovyst Inc. (the “Company”) will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ECVT2025 on Thursday, May 8, 2025 at 8:30 a.m. (Eastern Time) for the following purposes as further described in the Proxy Statement accompanying this notice:

• | To elect the two director nominees specifically named in the proxy statement, each to serve as Class III directors for a term of one year. |

• | To hold an advisory vote on the compensation paid by the Company to its named executive officers. |

• | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2025. |

• | To consider any other business properly brought before the Annual Meeting. |

Stockholders of record at the close of business on March 24, 2025 are entitled to notice of, and entitled to vote at, the Annual Meeting and any adjournments or postponements thereof.

The Company has determined to hold a virtual annual meeting in 2025 in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost. You will be able to attend the Annual Meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/ECVT2025. To participate in the virtual meeting, you will need the control number included on your proxy card or voting instruction form. The meeting webcast will begin promptly at 8:30 a.m. (Eastern Time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:15 a.m. (Eastern Time), and you should allow ample time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual stockholder meeting log in page.

By Order of the Board of Directors,

Joseph S. Koscinski

Secretary

Wayne, Pennsylvania

April 8, 2025

2025 PROXY STATEMENT |  | ||

ECOVYST INC.

PROXY STATEMENT

2025 ANNUAL MEETING OF STOCKHOLDERS

May 8, 2025

8:30 a.m. (Eastern Time)

INTRODUCTION

This Proxy Statement provides information for stockholders of Ecovyst Inc. (“we,” “us,” “our,” “Ecovyst” and the “Company”), as part of the solicitation of proxies by the Company and its board of directors (the “Board”) from holders of the outstanding shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), for use at the Company’s 2025 annual meeting of stockholders to be held as a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ECVT2025 on Thursday, May 8, 2025 at 8:30 a.m. (Eastern Time), and at any adjournments or postponements thereof (the “Annual Meeting”).

At the Annual Meeting, stockholders will be asked to vote either directly or by proxy on the following matters discussed herein:

1. | To elect the two director nominees specifically named in this Proxy Statement, each to serve as Class III directors for a term of one year (the “election of directors”) (Proposal 1). |

2. | To hold an advisory vote on the compensation paid by the Company to its named executive officers (the “say-on-pay proposal”) (Proposal 2). |

3. | To ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2025 (the “ratification of PwC”) (Proposal 3). |

4. | To consider any other business properly brought before the Annual Meeting. |

This Proxy Statement, the proxy card, and the Annual Report to stockholders for the fiscal year ended December 31, 2024 (“Annual Report”) are being first mailed to stockholders on or about April 8, 2025.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON MAY 8, 2025: THIS PROXY STATEMENT, THE ANNUAL

REPORT AND THE FORM 10-K FOR FISCAL 2024 ARE AVAILABLE AT WWW.PROXYVOTE.COM.

2025 PROXY STATEMENT |  | 1 | ||||

Although we encourage you to read this Proxy Statement in its entirety, we include this Question and Answers section to provide some background information and brief answers to several questions you might have about the Annual Meeting.

Why are we providing these materials?

Our Board is providing these materials to you in connection with our Annual Meeting, which will be a virtual meeting conducted exclusively via live webcast at www.virtualshareholdermeeting.com/ECVT2025 on May 8, 2025 at 8:30 a.m. (Eastern Time). Stockholders are invited to attend the Annual Meeting online and are requested to vote on the proposals described herein.

What information is contained in this Proxy Statement?

This Proxy Statement contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and named executive officers, and other required information.

What proposals will be voted on at the Annual Meeting?

There are three proposals scheduled to be voted on at the Annual Meeting:

• | Election of directors: |

• | Advisory vote on the say-on-pay proposal; and |

• | Ratification of PwC. |

We will also consider other business properly brought before the Annual Meeting.

Can I attend the Annual Meeting?

The Company has decided to hold a virtual annual meeting in order to facilitate stockholder attendance and participation by enabling stockholders to participate from any location and at no cost.

To participate in the virtual meeting, you will need the control number included on your proxy card or voting instruction form. The meeting webcast will begin promptly at 8:30 a.m. (Eastern Time). We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:15 a.m. (Eastern Time), and you should allow ample time for the check-in procedures. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual stockholder meeting log-in page.

We are committed to ensuring that stockholders will be afforded substantially the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend the Annual Meeting online, vote your shares electronically and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/ECVT2025. We will try to answer as many stockholder-submitted questions as time permits that comply with the meeting rules of conduct. However, we reserve the right to edit inappropriate language or to exclude questions that are not pertinent to meeting matters or that are otherwise inappropriate. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition.

What shares can I vote?

You may vote all shares of Common Stock that you owned as of the close of business on the record date, March 24, 2025. You may cast one vote per share, including shares (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a broker, bank, or other nominee. The proxy card will indicate the number of shares that you are entitled to vote.

As of March 24, 2025, there were 117,385,510 shares of Common Stock outstanding, all of which are entitled to be voted at the Annual Meeting. A list of stockholders will be available at our headquarters at 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087 for a period of at least ten days prior to the Annual Meeting.

2 |  | 2025 PROXY STATEMENT | |||||||

What is the difference between being a stockholder of record and a beneficial owner of shares held in street name?

Many of our stockholders hold their shares through brokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are differences between being a stockholder of record and a beneficial owner of shares held in street name.

Stockholder of record: If your shares are registered directly in your name with our transfer agent, Equiniti Trust Company, LLC, you are the stockholder of record with respect to those shares and the proxy materials were sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individual named on the proxy card and to vote at the Annual Meeting.

Beneficial owner of shares held in street name: If your shares are held in a brokerage account or by a bank or other nominee, then you are the “beneficial owner of shares held in street name” and the proxy materials were forwarded to you by your broker, bank or other nominee, who is considered to be the stockholder of record. As a beneficial owner of shares held in street name, you have the right to instruct the broker, bank or other nominee holding your shares how to vote your shares.

How do I vote?

There are four ways to vote:

• | By attending the Annual Meeting Online. During the Annual Meeting, you may vote online by following the instructions at www.virtualshareholdermeeting.com/ECVT2025. Have your proxy card or voting instruction form available when you access the virtual stockholder meeting webpage. |

• | Online. You may vote by proxy by visiting www.proxyvote.com and entering the control number found on your proxy card. The availability of online voting may depend on the voting procedures of the broker, bank or other nominee that holds your shares. |

• | Phone. You may vote by proxy by calling the toll-free number found on your proxy card. The availability of phone voting may depend on the voting procedures of the broker, bank or other nominee that holds your shares. |

• | Mail. You may vote by proxy by filling out your proxy card and returning it in the envelope provided. |

All shares represented by valid proxies received prior to the taking of the vote at the Annual Meeting will be voted and, where a stockholder specifies by means of the proxy a choice with respect to any matter to be acted upon, the shares will be voted in accordance with the stockholder’s instructions. Even if you plan on attending the Annual Meeting online, we encourage you to vote your shares in advance online, by phone, or by mail to ensure that your vote will be represented at the Annual Meeting.

Can I change my vote or revoke my proxy?

You may revoke your proxy and change your vote at any time before the taking of the vote at the Annual Meeting.

• | By Attending the Annual Meeting Online. You may revoke your proxy and change your vote by attending the Annual Meeting online and voting electronically during the meeting. However, your attendance online at the Annual Meeting will not automatically revoke your proxy unless you properly vote electronically during the Annual Meeting or specifically request that your prior proxy be revoked by delivering a written notice of revocation prior to the Annual Meeting to Ecovyst’s Secretary at 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087. |

• | Online. You may change your vote using the online voting method described above, in which case only your latest internet proxy submitted prior to the Annual Meeting will be counted. |

• | Phone. You may change your vote using the phone voting method described above, in which case only your latest telephone proxy submitted prior to the Annual Meeting will be counted. |

• | Mail. You may revoke your proxy and change your vote by signing and returning a new proxy card dated as of a later date, in which case only your latest proxy card received prior to the Annual Meeting will be counted. |

2025 PROXY STATEMENT |  | 3 | ||||

What happens if I do not instruct how my shares should be voted?

Stockholders of record. If you are a stockholder of record and you:

• | indicate when voting online or by phone that you wish to vote as recommended by the Board; or |

• | sign and return a proxy card without giving specific instructions, |

then the person named as proxy holder, Joseph S. Koscinski, will vote your shares in the manner recommended by the Board on all matters presented in this Proxy Statement and as he may determine in his best judgment with respect to any other matters properly presented for a vote at the Annual Meeting.

Beneficial owners of shares held in street name. If you are a beneficial owner of shares held in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, then the broker, bank or other nominee that holds your shares may generally vote your shares in their discretion on “routine” matters, but cannot vote on “non-routine” matters.

What are routine and non-routine proposals?

The following proposal is considered a routine matter:

• | Ratification of PwC (Proposal 3). |

A broker, bank or other nominee may generally vote in their discretion on routine matters, and therefore no broker non-votes (as described below) are expected in connection with Proposal 3.

The following proposals are considered non-routine matters:

• | Election of directors (Proposal 1); and |

• | Advisory vote on the say-on-pay proposal (Proposal 2). |

If the broker, bank or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that broker, bank or other nominee will inform the inspector of election that it does not have the authority to vote on the matter with respect to your shares. This is generally referred to as a “broker non-vote.” Therefore, broker non-votes may exist in connection with Proposals 1 and 2.

What constitutes a quorum for the Annual Meeting?

The presence at the Annual Meeting, online or by proxy, of the holders of Common Stock representing a majority of the shares outstanding and entitled to vote for the election of directors is necessary to constitute a quorum for all purposes.

What vote is required to approve each proposal?

Proposal 1: Election of directors. Directors are elected by a plurality of the votes cast. Therefore, if you do not vote for a nominee, or you “withhold authority to vote” for a nominee, your vote will not count either “for” or “against” the nominee.

Proposal 2: Advisory vote on the say-on-pay proposal. Generally, approval of any matter presented to stockholders (other than the election of directors) requires the affirmative vote of a majority of the votes cast on the matter. However, because this proposal asks for a non-binding, advisory vote, there is no “required” vote that would constitute approval.

Proposal 3: Ratification of PwC. The affirmative vote of a majority of the votes cast is required to ratify the selection of PwC as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2025.

4 |  | 2025 PROXY STATEMENT | |||||||

What effect will broker non-votes and abstentions have?

Broker non-votes and abstentions are counted as present and entitled to vote for purposes of determining whether a quorum is present. Broker non-votes and abstentions will have no effect on the outcome of Proposals 1 and 2. No broker non-votes are expected in connection with Proposal 3.

Who pays for costs relating to the proxy materials and Annual Meeting?

The costs of preparing, assembling, and mailing this Proxy Statement, the proxy card, and the Annual Report, along with the cost of posting the proxy materials on a website, are to be borne by us. In addition to the use of mail, our directors, officers, and employees may solicit proxies personally and by telephone, facsimile, and other electronic means. They will receive no compensation in addition to their regular compensation. We may request banks, brokers and other custodians, nominees, and fiduciaries forward copies of the proxy materials to their principals and request authority for the execution of proxies. We may reimburse these banks, brokers, and other custodians for their expenses in doing so.

Who should I call if I have any questions?

If you have any questions about the Annual Meeting, voting or your ownership of our Common Stock, please call us at (484) 617-1200 or send an email to InvestorRelations@ecovyst.com.

2025 PROXY STATEMENT |  | 5 | ||||

ELECTION OF DIRECTORS

The Company currently has a classified Board consisting of two directors with terms expiring in 2025 (Class II), three directors with terms expiring in 2026 (Class III), and three directors with terms expiring in 2027 (Class I). At the 2024 annual meeting of stockholders, the stockholders voted to approve a proposal to amend the Company’s Second Restated Certificate of Incorporation, as amended and corrected (the “Charter”), to eliminate the classified board structure beginning at this Annual Meeting (the “Charter Amendment”). The Charter Amendment provides that, subject to the special rights of the holders of any series of Preferred Stock to elect directors, (a) at the 2025 annual meeting of stockholders, the Board will be classified into two classes, Class I and Class III and that each of the successors of the current Class II directors will be nominated for election as Class III directors with a term to expire at the 2026 annual meeting of stockholders, and (b) commencing with the election of directors at the annual meeting of stockholders to be held in 2026, there shall be a single class of directors, Class I, with all directors of such class having a term that expires at the annual meeting of stockholders to be held in 2027. From and after the annual meeting of stockholders to be held in 2027, the Board shall cease to be classified, and thereafter, all directors shall be elected for terms expiring at the next succeeding annual meeting of stockholders. Ms. Ward and Mr. Brown are the Class II directors whose terms expire at the Annual Meeting.

Our Board has nominated, and stockholders are being asked to re-elect, Ms. Ward and Mr. Brown as Class III directors with terms expiring at our 2026 annual meeting of stockholders. If elected, the nominees will each hold office until our 2026 annual meeting of stockholders, subject to the election and qualification of each such nominee’s successor and such successor’s earlier death, resignation, or removal.

Each of the above nominees has indicated his or her willingness to serve, if elected. However, if a nominee should be unable to serve, the shares of Common Stock represented by proxies may be voted for a substitute nominee designated by the Board. Management has no reason to believe that any of the above-mentioned persons will not serve his or her term as a director.

We believe that all our nominees possess the professional and personal qualifications necessary for Board service, and we have highlighted particularly noteworthy attributes for each director in the individual biographies below.

The Board recommends a vote “FOR” the election of each of the director nominees.

The following table sets forth the name, age, and class, as of March 1, 2025, of individuals who currently serve as directors on our Board.

Name | Age | Position | Class | ||||||||

Anna C. Catalano | 65 | Director | Class I | ||||||||

Sarah Lorance | 51 | Director | Class I | ||||||||

Donald Althoff | 68 | Director | Class I | ||||||||

Susan F. Ward | 64 | Director | Class II | ||||||||

Bryan K. Brown | 57 | Director | Class II | ||||||||

Kevin M. Fogarty | 59 | Non-Executive Chairman | Class III | ||||||||

Kurt J. Bitting | 49 | Director and CEO | Class III | ||||||||

David A. Bradley | 54 | Director | Class III | ||||||||

6 |  | 2025 PROXY STATEMENT | |||||||

Class II – Directors with Terms Expiring in 2025

| SUSAN F. WARD Age: 64 Independent Director | Susan F. Ward has served on our Board since 2020. A respected accounting professional, Ms. Ward spent 27 years serving in a variety of roles at United Parcel Service, Inc. (“UPS”), most recently as its Chief Accounting Officer from 2015 until her retirement in August 2019. Prior to her tenure at UPS, Ms. Ward spent 10 years at Ernst & Young in Assurance Services. Ms. Ward has served on the board of Saia, Inc. since November 2019 and currently serves as the chairperson of its Audit Committee. Since September 2021, she also has served as a member of the board of Global Business Travel Group, Inc., where she also serves as chairperson of its Audit Committee and as a member of its Risk Management and Compliance Committee. Ms. Ward is well qualified to serve on our Board and she was re-nominated to serve on the Board for election at this Annual Meeting because of her years of experience as a senior financial executive of a multi-national business, as well as her public accounting experience. | ||||

| BRYAN K. BROWN Age: 57 Independent Director | Bryan K. Brown has served on our Board since April 2022. Mr. Brown has served as a partner at Jones Day in its Financial Markets – Capital Markets practice since April 2019. Prior to joining Jones Day, Mr. Brown served as a partner at Reed Smith from November 2013 to April 2019, at Thompson Knight from March 2012 to November 2013, and Porter Hedges from May 1998 to February 2012. Mr. Brown currently serves as a member of the board of advisors of the College of Business at Sam Houston University and The John Cooper School, where he is a member of the Audit Committee. Prior to entering private practice, Mr. Brown worked at the Division of Corporate Finance at the U.S. Securities and Exchange Commission. Mr. Brown is an active member of the National Association of Corporate Directors (“NACD”), and has completed the NACD Directorship Certified® program. From September 1986 until September 2006, Mr. Brown served in the U.S. Army and he was honorably discharged at the rank of Captain in September 2006. Mr. Brown is well qualified to serve on our Board and he was re-nominated to serve on the Board for election at this Annual Meeting because of his extensive experience advising public companies and his extensive leadership experience. | ||||

2025 PROXY STATEMENT |  | 7 | ||||

Class III – Directors with Terms Expiring in 2026

| KURT J. BITTING Age: 49 Director and Chief Executive Officer | Kurt J. Bitting has served on our Board since April 2022. Mr. Bitting became our Chief Executive Officer in April 2022. Prior to that, he served as our Vice President and President—Ecoservices (formerly Refining Services) from March 2019 to April 2022. From September 2017 until February 2019, Mr. Bitting served as our Vice President of Ecoservices. Between May 2016 and August 2017, he was our Business Director in the Eco Services business. Mr. Bitting also previously held management positions at Kinder Morgan, Inc., Sprint Corporation, Solvay USA Inc., and Eco Services Operations LLC. Mr. Bitting began his career in the U.S. Army where he served as a Company Commander in the 10th Mountain Division. Mr. Bitting is well qualified to serve on our Board because of his extensive management and leadership experience. | ||||

| DAVID A. BRADLEY Age: 54 Independent Director | David A. Bradley has served on our Board since April 2022. Since March 2019, Mr. Bradley has served as the President and Chief Executive Officer and member of the board of directors of SI Group. Prior to joining SI Group, Mr. Bradley served as President and Chief Executive Officer and member of the board of directors of Nexeo Solutions between 2011 and 2019. Prior to that, Mr. Bradley spent seven years at Kraton Corporation, where he held several executive positions, including Chief Operating Officer, Vice President of Global Operations, and Vice President of Business Transformation. Since 2019, he also has been a member of the board of directors of South Texas Truck Centers LLP. Mr. Bradley is well qualified to serve on our Board because of his extensive experience in the chemicals sector and his extensive management and leadership experience,. | ||||

| KEVIN M. FOGARTY Age: 59 Non-Executive Chairman and Independent Director | Kevin M. Fogarty became a director and our Chairman in April 2022, and he became chairman of our Nominating and Corporate Governance Committee in July 2022, serving in that position until December 31, 2023. From January 2008 until March 2022, Mr. Fogarty served as Kraton Corporation’s President and Chief Executive Officer and as a member of its board of directors from September 2009 until March 2022. From May 2005 to December 2007, he served as Kraton’s Executive Vice President of Global Sales and Marketing. From May 2004 to April 2005, Mr. Fogarty served as President, Polymers and Resins, of Invista. From 1991 to April 2004, Mr. Fogarty held a variety of roles within the Koch Industries, Inc. family of companies. Since November 2024, Mr. Fogarty has served as Chairman of the board of directors and as a member of the Compensation Committee of Magnera Corporation, which was created as a result of the November 2024 merger of P.H. Glatfelter Company and the Health, Hygiene and Specialties Global Nonwovens and Films business of Berry Global. Prior to the creation of Magnera Corporation and between 2012 and November 2024, he served as Chairman of the board of directors of Glatfelter and also served on its Compensation Committee and Nominating and Corporate Governance Committee. Since 2022, he also has served on the board of directors of OPAL Fuels Inc., where he also serves on its Audit and Compensation Committees. He formerly has served as a director of the American Chemistry Council. Mr. Fogarty is well qualified to serve on our Board because of his extensive experience in the chemicals sector and his extensive management and leadership experience. | ||||

8 |  | 2025 PROXY STATEMENT | |||||||

Class I – Directors with Terms Expiring in 2027

| ANNA C. CATALANO Age: 66 Independent Director | Anna C. Catalano has served on our Board since July 2022. Ms. Catalano has over 30 years of business experience, including senior roles at BP plc and its predecessor company, Amoco Corporation, until her retirement in 2003 and two decades of public and private board service. In September 2008, she co-founded The World Innovation Network, a nonprofit network of innovators to work toward global prosperity, and continued to work with that organization until 2021. Since 2017, she has served on the board of directors of HF Sinclair Corporation, where she is a member of the Nominating, Governance and Social Responsibility and Compensation Committees. Since 2018, she has served on the board of directors of Frontdoor, Inc., where she is the chair of the Compensation Committee. Since May 2022, she has served on the board of directors of Hexion, Inc. Previously, she served on the boards of directors of Willis Towers Watson from June 2006 until June 2022 and Kraton Corporation from September 2011 until March 2022. Ms. Catalano is well qualified to serve on our Board because of her experience in, and knowledge of, the refining sector, including with respect to both traditional and renewable fuels, and extensive experience serving as both a public and private company director,. | ||||

| SARAH LORANCE Age: 51 Independent Director | Sarah Lorance has served on our Board since March 2024. Ms. Lorance has over 25 years of business experience, including as Owner and Executive Consultant at Autumn Advisors, LLC since November 2021 and in various capacities from March 1998 to October 2020 at Elevance Health, Inc. (formerly Anthem, Inc.), where she most recently served as Chief Compliance Officer. Additionally, she has served on the board of directors of VSP Vision since January 2024, where she is a member of the Finance and Audit Committees. Ms. Lorance has also served on the board of directors of the Knoebel Institute of Healthy Aging at the University of Denver since September 2023, where she is an advisory board member. Between January 2015 and October 2024, she served on the board of directors of the Alzheimer's Association, where she was Chair of the Board, Chair of the Executive Committee, and a member of the Compensation, Governance and Nominating, Finance and Audit Committees. She holds a B.B.A. degree in Accounting from the University of Iowa. She also is a certified public accountant (inactive) and is NACD Directorship Certified®. Ms. Lorance is well qualified to serve on our Board because of her finance, risk management, compliance, and general business experience. | ||||

| Donald Althoff Age: 68 Independent Director | Donald Althoff has served on our Board since May 2024. Mr. Althoff has over 40 years of experience in the chemical and energy industries. From September 2019 to September 2022, he served as Director and Chairman of the Board of Vereson Midstream LP, and from September 2019 to December 2022, he served as Director of Alliance Pipeline and Aux Sable LP. From October 2017 to September 2019, he served as President and Chief Executive Officer of Veresen Midstream LP, and he served as President and Chief Executive Officer of Veresen Inc. from November 2012 to September 2017. From October 2008 to September 2012, he served as President and Chief Executive Officer at Flex Fuel. From 1981 to 2008, Mr. Althoff served in roles of increasing responsibility with Amoco Corporation and BP PLC. Mr. Althoff holds a Bachelor of Science in Chemical Engineering from the University of Illinois. Mr. Althoff is well qualified to serve on our Board because of his experience in the chemical and energy industries as well as his general business experience. | ||||

2025 PROXY STATEMENT |  | 9 | ||||

Director Compensation

In accordance with our non-employee director compensation policy, which has been in place since the time of our initial public offering (“IPO”), each of our non-employee directors is compensated as follows:

• | Each eligible non-employee director receives an annual cash retainer of $50,000. |

• | The chairperson of the Audit Committee receives an additional annual cash retainer of $20,000. |

• | The chairperson of each committee, other than the Audit Committee, receives an additional annual cash retainer of $15,000. |

• | Each eligible non-employee director receives an annual equity grant in the form of restricted stock units (“RSUs”) with a grant date fair value of $200,000. The terms of each such award are set forth in an award agreement between each director and us, which generally provides for vesting after one year of continued service as a director or upon an earlier occurrence of a change in control. |

Mr. Fogarty receives the standard director pay package outlined above, plus a $250,000 fee differential for his service as Non-Executive Chairman. The fee differential is paid in the form of an additional annual cash retainer of $50,000 and additional RSUs with a grant date fair value of $200,000. As is the case with the RSUs granted to other non-employee directors, the restricted stock units which form a part of the fee differential provide for vesting after one year of continued service as director or upon an earlier occurrence of a change in control.

All cash and equity awards granted under the non-employee director compensation policy are granted under, and subject to the limits of, the Ecovyst Inc. 2017 Omnibus Incentive Plan, as amended and restated (the “2017 Plan”). Annual cash retainers are paid quarterly in arrears.

On January 22, 2024, the Company granted 22,701 RSUs to each of Messrs. Bradley and Brown, Ms. Catalano, and Ms. Ward. Each award vested subject to the director’s continued service through January 22, 2025 (or upon an earlier occurrence of a change in control). In addition, on January 22, 2024 the Company granted 45,402 RSUs to Mr. Fogarty, consisting of 22,701 RSUs for his service on the Board and 22,701 RSUs as a part of the fee differential for his service as Non-Executive Chair of the Board. Each award of RSUs vested subject to Mr. Fogarty’s continued service through January 22, 2025 (or upon an earlier occurrence of a change in control). On March 8, 2024, the Company granted 18,077 RSUs to Ms. Lorance in connection with her appointment to the Board. The award vested subject to Ms. Lorance’s continued service through March 8, 2025 (or upon an earlier occurrence of a change in control). On May 20, 2024, the Company granted 13,303 RSUs to Mr. Althoff in connection with his election as a director at the 2024 annual meeting of stockholders. The award vests subject to Mr. Althoff’s continued service through May 20, 2025 (or upon an earlier occurrence of a change in control).

Stock Ownership Guidelines for Non-Employee Directors

Under our stock ownership guidelines applicable to our non-employee directors, each of our non-employee directors is expected to have ownership of Company stock in an amount equal to at least $625,000. Non-employee directors have five years to achieve the required ownership levels and, until they satisfy their ownership requirements, are subject to a holding requirement with respect to 50% of the shares they acquire upon the vesting or exercise of equity-based awards (on an after-tax basis).

10 |  | 2025 PROXY STATEMENT | |||||||

The following table summarizes the ownership of our Common Stock as of December 31, 2024 by our non-employee directors who were serving on our Board as of December 31, 2024:

Name | Ownership Requirement | Ownership(1) | ||||||

Anna Catalano(2) | $625,000 | 0.68x | ||||||

David Bradley(3) | $625,000 | 0.98x | ||||||

Bryan Brown(4) | $625,000 | 0.76x | ||||||

Kevin Fogarty(5) | $625,000 | 1.96x | ||||||

Susan F. Ward(6) | $625,000 | 0.80x | ||||||

Don Althoff(7) | $625,000 | 0.16x | ||||||

Sarah Lorance(8) | $625,000 | 0.21x | ||||||

(1) | Calculated using the average closing price of $7.39 during the 90-day period preceding December 31, 2024, in accordance with the terms of our stock ownership guidelines. Ownership multiples are rounded to the nearest one-hundredth. |

(2) | Ms. Catalano joined our Board on July 27, 2022 and therefore has until July 27, 2027 to satisfy the stock ownership requirement. |

(3) | Mr. Bradley joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement. |

(4) | Mr. Brown joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement. |

(5) | Mr. Fogarty joined our Board on April 27, 2022 and therefore has until April 27, 2027 to satisfy the stock ownership requirement, although he satisfied the requirement as of December 31, 2024. |

(6) | Ms. Ward joined our Board on June 1, 2020 and therefore has until June 1, 2025 to satisfy the stock ownership requirement. |

(7) | Mr. Althoff joined our Board on May 8, 2024, and therefore has until May 8, 2029 to satisfy the stock ownership requirement. |

(8) | Ms. Lorance joined our Board on March 1, 2024, and therefore has until March 1, 2029 to satisfy the stock ownership requirement. |

Director Compensation Table

The following table sets forth certain information with respect to cash compensation and stock awards granted to our non-employee directors in 2024. Mr. Bitting did not receive compensation for his service on our Board in 2024. The compensation that he received in his capacity as an executive officer of the Company is reported in the Summary Compensation Table below.

Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Non-Equity Incentive Plan Compensation ($) | All Other Compensation ($) | Total ($) | ||||||||||||

David A. Bradley | $65,000 | $200,041 | — | — | $265,041 | ||||||||||||

Bryan K. Brown | $50,000 | $200,041 | — | — | $250,041 | ||||||||||||

Anna C. Catalano | $65,000 | $200,041 | — | — | $265,041 | ||||||||||||

Robert Coxon(3) | $23,036 | $200,041 | — | — | $223,077 | ||||||||||||

Kevin M. Fogarty | $100,000 | $400,082 | — | — | $500,082 | ||||||||||||

Kyle Vann(4) | $17,720 | $200,041 | — | — | $217,761 | ||||||||||||

Susan F. Ward | $70,000 | $200,041 | — | — | $270,041 | ||||||||||||

Sarah Lorance(5) | $41,667 | $167,212 | — | — | $208,879 | ||||||||||||

Don Althoff(6) | $42,143 | $130,103 | — | — | $130,103 | ||||||||||||

(1) | As described above and in addition to the annual cash retainer of $50,000 for Board service, Ms. Ward, Ms. Catalano and Messrs. Bradley, Althoff, and Coxon received an additional annual retainer for their service as committee chairs. Ms. Ward served as chair of the Audit Committee and received an additional annual retainer of $20,000 for such service. Ms. Catalano served as chair of the Nominating and Corporate Governance Committee and received an additional annual retainer of $15,000 for such service. Mr. Bradley served as chair of the Compensation Committee and received an additional annual retainer of $15,000 for such service. Mr. Coxon served as the chair of the Health, Safety, Environment and Security Committee from January 1, 2024 until his resignation from the Board on May 8, 2024 and he received an additional retainer of $5,275 for such service during such period. Mr. Althoff replaced Mr. Coxon as chair of the Health, Safety, Environment and Security Committee effective on May 8, 2024 and received an additional retainer of $9,725 for such service in 2024. As described above, Mr. Fogarty receives the standard director pay package outlined above plus a $250,000 annual fee differential for his service as Non-Executive Chairman. The fee differential is paid in the form of an additional annual cash retainer of $50,000 and additional RSUs with a grant date fair value of $200,000. |

(2) | As required by Securities and Exchange Commission (“SEC”) rules, amounts shown present the aggregate grant date fair value of RSU and stock awards granted to our non-employee directors during 2024, calculated in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 718 (“ASC Topic 718”), excluding the effect of any estimated forfeitures. For information on the valuation assumptions made in the calculation of these amounts, refer to Note 21 to the audited consolidated financial statements in our Form 10-K for the fiscal year ended December 31, 2024. |

(3) | Mr. Coxon resigned from our Board effective on May 8, 2024 for health reasons. |

(4) | In accordance with the Board’s Director Retirement Policy, Mr. Vann did not stand for re-election to the Board at the 2024 Annual Meeting of Stockholders and left the Board on May 8, 2024. |

(5) | Ms. Lorance was appointed to our Board effective on March 1, 2024. |

(6) | Mr. Althoff was elected to our Board at the 2024 Annual Meeting of Stockholders on May 8, 2024. |

2025 PROXY STATEMENT |  | 11 | ||||

✔ | Board declassification process commences at the 2025 Annual Meeting | ✔ | Stock ownership guidelines applicable to directors and named executive officers | ||||||||

✔ | Seven of our eight directors are independent | ✔ | Board retirement / tenure policy promotes refreshment | ||||||||

✔ | All Board committees are comprised of independent directors | ✔ | No stockholder rights plan in effect | ||||||||

✔ | Non-Executive Board Chair | ✔ | Shareholder action by written consent permitted | ||||||||

✔ | Half of our directors are diverse | ✔ | No supermajority vote to remove directors or amend charter or bylaws | ||||||||

✔ | Robust Board continuing education program | ✔ | Active oversight of risk and strategy by Board and management | ||||||||

✔ | Regular meetings of non-management, independent directors | ✔ | Robust Code of Conduct applicable to directors, officers, and employees | ||||||||

Governance Review and Governance Changes

As a result of the Board’s review of the Company’s corporate governance framework in 2023 to determine if changes to our policies and practices were warranted, the Board included the Charter Amendment on the ballot for the 2024 annual meeting of stockholders. The stockholders voted to approve the Charter Amendment, which provides that following a two-year transition period, the Company’s stockholders will vote on the election of the entire Board on an annual basis. The Board’s decision to propose the Charter Amendment at the 2024 annual meeting of stockholders was informed by the current trend in corporate governance leading away from classified boards in favor of electing all directors annually, and the Board’s recognition that a classified board structure may reduce directors’ accountability to stockholders because stockholders are not provided the opportunity to express a view on each director’s performance by means of an annual vote.

The Board is committed to adhering to best practices in corporate governance. From time to time, the Board will continue to evaluate the governance structure for the Company and may make changes if they are deemed to be in the best interest of the Company and its stockholders.

Our Board currently consists of eight members, with Mr. Fogarty serving as Non-Executive Chairman of the Board. In this capacity, Mr. Fogarty leads all meetings of the Board and of its non-management, independent directors consistent with the provisions of our Corporate Governance Guidelines. Our Board and its committees meet periodically throughout the year, as needed, to oversee management of the Company’s business and affairs for the benefit of its stockholders. During 2024, the Board held nine meetings. Each director other than Mr. Coxon attended more than 75% of Board meetings and meetings of its applicable committees on which such directors served in 2024 (during the periods when they served). Mr. Coxon resigned from the Board effective May 8, 2024 due to health reasons and, unfortunately, passed away in December 2024. We encourage, but do not require, our directors to attend annual meetings of stockholders and all of the then-sitting directors attended our 2024 annual meeting of stockholders (other than those directors who were not continuing service following the 2024 annual meeting of stockholders).

As set forth in our Corporate Governance Guidelines, our Board and its committees regularly have access to those Company employees as the Board or its committees deems necessary to effectively oversee the management of the Company. At each of our regularly scheduled Board and committee meetings, our executive management team and other Company employees provide information regarding their respective businesses and functions and the Board members have the opportunity to pose questions to such executives and employees.

12 |  | 2025 PROXY STATEMENT | |||||||

Also consistent with our Corporate Governance Guidelines, the Board and its committees have the opportunity to engage outside advisers to provide such advice as the Board or its committees requires to effectively oversee the management of the Company.

Periodically throughout the year, the non-employee and independent directors meet in executive session without members of management present. These meetings allow such non-employee and independent directors to discuss issues of importance to the Company, including the business and affairs of the Company and matters concerning management, without any member of management present. As noted above, Mr. Fogarty presides over all such meetings. During 2024, the non-employee and independent directors met without management present at seven meetings of the Board.

In an effort to ensure that Board members have adequate information about the Company and its operations as well as good governance practices, the Board receives regular education sessions or “Teach-Ins” from Company employees and outside advisors on various topics relating to the Board’s oversight function for the Company. Those sessions have included educational presentations relating to production of advanced silicas, the Ecoservices segment’s utilization of natural gas as an energy source, global sustainability regulations, biocatalysts and the Company’s business in that sector, and various enterprise risk management topics. Directors also are encouraged to participate in director education programs other than those sponsored by the Company in order to stay abreast of governance best practices, emerging issues and trends that impact public company boards.

Our Corporate Governance Guidelines provide that our Board shall consist of the number of directors who are independent as is required and determined in accordance with applicable laws and regulations and requirements of the New York Stock Exchange (“NYSE”) and SEC rules. Under our Corporate Governance Guidelines, an “independent” director is one who meets the qualification requirements for being an independent director under applicable laws and the corporate governance listing standards of the NYSE. Our Board evaluates any relationships between each director or director nominee and the Company and makes an affirmative determination whether or not such director or director nominee is independent. As a result of this review, our Board has affirmatively determined that each current member of our Board, with the exception of Mr. Bitting, our Chief Executive Officer, is independent under applicable laws and the corporate governance listing standards of the NYSE.

Our Corporate Governance Guidelines provide that the Nominating and Corporate Governance Committee is responsible for reporting annually to the Board an evaluation of the overall performance of the Board. In addition, the written charters of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee provide that each such committee shall evaluate its performance on an annual basis using criteria that it has developed and shall report to the Board on its findings. The Board and each committee of the Board conducts such performance reviews on an annual basis.

During fiscal 2024, the Board had four standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, and the Health, Safety, Environment and Security Committee. The charter for each committee can be found in the Investors section of our website at https://investor.ecovyst.com under “Management & Governance” and more information about the primary roles and responsibilities of each committee is set forth below. The members of each committee are appointed by the Board, and, consistent with our Corporate Governance Guidelines, the Board takes into consideration the particular skills of Board members when appointing members to each committee. In addition, from time to time, special committees may be established under the direction of the Board when necessary to address specific issues.

The chairpersons of the standing Board committees regularly provide reports to the full Board regarding the topics of discussions of their respective committee meetings and actions taken at such committee meetings.

2025 PROXY STATEMENT |  | 13 | ||||

The table below provides information about the membership of our standing Board committees during fiscal 2024:

Name | Audit | Compensation | Nominating and Corporate Governance | Health, Safety, Environment and Security | ||||||||||

Susan F. Ward | * | |||||||||||||

Kyle Vann(1) | X | X | ||||||||||||

Robert Coxon(2) | X | * | ||||||||||||

Don Althoff(3) | * | |||||||||||||

Kevin M. Fogarty(4) | X | X | ||||||||||||

David A. Bradley | * | X | ||||||||||||

Bryan K. Brown | X | X | ||||||||||||

Anna C. Catalano | X | * | ||||||||||||

Sarah Lorance(5) | X | |||||||||||||

Kurt Bitting(6) | X | |||||||||||||

Number of meetings during fiscal 2024 | 5 | 5 | 2 | 2 | ||||||||||

* | Committee Chair |

(1) | Mr. Vann served as a member of our Audit Committee and Compensation Committee from January 1, 2024 through May 8, 2024, when he resigned from our Board and did not stand for re-election at our 2024 annual meeting of stockholders. |

(2) | Mr. Coxon served as Chair of our Health, Safety, Environment and Security Committee and as a member of our Audit Committee from January 1, 2024 through May 8, 2024, when he resigned from our Board for health reasons. Effective upon Mr. Coxon’s resignation on May 8, 2024, Mr. Althoff became Chair of our Health, Safety, Environment and Security Committee. |

(3) | Mr. Althoff became Chair of our Health, Safety, Environment and Security Committee effective upon Mr. Coxon’s resignation from the Board on May 8, 2024 and served in such capacity through December 31, 2024. |

(4) | Mr. Fogarty served as a member of our Nominating and Corporate Governance Committee during the entirety of 2024. On May 8, 2024, Mr. Fogarty became a member of our Compensation Committee. |

(5) | Ms. Lorance became a member of our Audit Committee on May 8, 2024. |

(6) | Mr. Bitting became a member of our Health, Safety, Environment and Security Committee on May 8, 2024. |

14 |  | 2025 PROXY STATEMENT | |||||||

Additional information regarding our Board committees and their roles is set forth below:

Audit Committee — Among other matters, the Audit Committee’s duties and responsibilities are to:

• | appoint or replace, compensate, and oversee the Company’s independent auditors, who will report directly to the Audit Committee, for the purpose of preparing or issuing an audit report or related work or performing other audit, review or attest services for us; |

• | pre-approve all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for us by our outside auditors, subject to de minimis exceptions that are approved by the Audit Committee prior to the completion of the audit; |

• | review and discuss with management and the outside auditors the annual audited and quarterly unaudited financial statements, our disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the selection, application and disclosure of critical accounting policies and practices used in the financial statements; |

• | discuss with management and the outside auditors any significant financial reporting issues and judgments made in connection with the preparation of our financial statements, including any significant changes in our selection or application of accounting principles; |

• | review and discuss with management our legal, regulatory and compliance programs, including procedures and practices relating to compliance with applicable anti-corruption and anti-bribery laws and swaps transactions; |

• | oversee our enterprise risk management program; |

• | oversee our cybersecurity risk mitigation efforts and the disclosure of cyber incidents if such disclosure is required by SEC rules; and |

• | review and discuss with management and the independent auditor any major issues as to the adequacy of our internal controls and any special steps adopted in light of material control deficiencies. |

The members of our Audit Committee as of the date of this Proxy Statement are Susan F. Ward (Chair), Bryan K. Brown and Sarah Lorance. Our Board has determined that Ms. Ward, Mr. Brown, and Ms. Lorance each meet the independence requirements of Rule 10A-3 under the Exchange Act, and the governance and listing standards of the NYSE. All of the members of the Audit Committee are financially literate and each of Ms. Ward, Ms. Lorance and Mr. Brown is also considered an “audit committee financial expert” within the meaning of the applicable rules of the SEC.

Compensation Committee — Among other matters, the Compensation Committee’s duties and responsibilities are to:

• | review the Company’s overall compensation strategy, including base salary, incentive compensation and equity-based grants, to provide for appropriate rewards and incentives for the Company’s management and employees; |

• | review and approve corporate goals and objectives relevant to our Chief Executive Officer and other executive officer compensation; |

• | evaluate the performance of our Chief Executive Officer and other executive officers in light of those goals and objectives; |

• | determine and approve the compensation of our Chief Executive Officer and other executive officers; and |

• | administer the Company’s equity-based plans and management incentive compensation plans and grant awards under such plans. |

The Compensation Committee as of the date of this Proxy Statement consists of David A. Bradley (Chair), Anna Catalano and Kevin M. Fogarty. Our Board has determined that each member of the Compensation Committee meets the independence requirements under the governance and listing standards of the NYSE and are “non-employee directors” under Rule 16b-3 of the Exchange Act.

2025 PROXY STATEMENT |  | 15 | ||||

Nominating and Corporate Governance Committee — Among other matters, the Nominating and Corporate Governance Committee’s duties and responsibilities are to:

• | identify individuals qualified to become Board members, receive nominations for such qualified individuals, recommend director nominees to the Board and recommend qualified individuals to serve as committee members on the various Board committees; |

• | review our Corporate Governance Guidelines at least on an annual basis and recommend changes as necessary; |

• | articulate to the directors what service on the Board entails, including reference to our Corporate Governance Guidelines and the basic responsibilities of directors with respect to attendance at Board meetings and advance review of meeting materials; |

• | review the Company’s practices and policies regarding Board size, retirement and tenure requirements, Board refreshment and service of non-employee directors; |

• | recommend to the Board and its committees the processes for annual evaluations of the Board and its committees; |

• | oversee the Company’s ethics and compliance functions, including our Code of Conduct and Code of Ethics for Senior Executives and Financial Officers (“Code of Ethics”); |

• | oversee Company policies with respect to significant issues of corporate public responsibility, including political contributions; and |

• | review and approve all related party transactions to the extent such transactions are required to be disclosed in any public filings made by the Company pursuant to Item 404 of Regulation S-K. |

The Nominating and Corporate Governance Committee as of the date of this Proxy Statement consists of Anna C. Catalano (Chair), Kevin M. Fogarty, and Bryan K. Brown. Our Board has determined that each member of the Nominating and Corporate Governance Committee is independent as defined under the governance and listing standards of the NYSE.

Health, Safety, Environment and Security Committee — Among other matters, the Health, Safety, Environment and Security Committee’s duties and responsibilities are to:

• | review the Company’s health, safety, environmental, security and sustainability policies, initiatives and performance; |

• | review management systems designed to ensure compliance with applicable laws, regulations and Company standards with respect to health, safety, environmental, security and sustainability matters; |

• | review and provide input to the Company on the management of current and emerging health, safety, environmental, security and sustainability issues; and |

• | review the organization’s progress and performance in achieving goals, targets and objectives with respect to health, safety, environment, security and sustainability. |

The Health, Safety, Environment and Security Committee as of the date of this Proxy Statement consists of Donald Althoff (Chair), Kurt Bitting, and David A. Bradley.

None of our executive officers serves as a member of the board of directors or compensation committee, or other committee serving an equivalent function, of any other entity that has one or more of its executive officers serving as a member of our Board or Compensation Committee.

16 |  | 2025 PROXY STATEMENT | |||||||

It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to the Company. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to the Company. The Board believes that evaluating the executive team’s management of the various risks confronting the Company is one of its most important areas of oversight.

In accordance with this responsibility, the Board administers its risk oversight role directly and through its committee structure and the committees’ regular reports to the Board at Board meetings. The Board reviews strategic, financial and execution risks and exposures associated with the annual plan and long-term plans, material litigation and other matters that may present material risk to the Company’s operations, plans, prospects or the Company’s reputation, acquisitions and divestitures, senior management succession planning and enterprise risk management.

In connection with risk oversight, Board committees assist with the review, assessment and oversight of the Company’s risk management efforts. The chart below sets forth some examples of the roles Board committees play in risk oversight:

Committee | Risk Oversight Areas | ||||

Audit Committee | • The design, adequacy and effectiveness of our internal controls • Review of our earnings releases and quarterly and annual report filings with the SEC • Review of the design and execution of the Company’s enterprise risk management program and material risks identified as part of annual review of Company risks • The integrity of the Company’s information technology systems, the adequacy of security measures taken to protect such systems and disclosure of material cyber incidents in accordance with SEC rules | ||||

Compensation Committee | • Whether the Company’s compensation policies and practices provide appropriate incentives to management or encourage undue risk-taking by management • Applying, if necessary, the clawback provisions of the 2017 Plan and the Company’s Policy for Recoupment of Incentive Compensation that complies with SEC and NYSE requirements and provides additional rights to the Company to clawback time-based compensation under the 2017 Plan • Administration and oversight of stock ownership guidelines for directors and executive officers • Establishment of Chief Executive Officer and other executive officer compensation based on performance reviews • Oversight of employee recruiting and retention, compensation and benefits | ||||

Nominating and Corporate Governance Committee | • Compliance with ethical requirements, including avoidance of conflicts of interest • Corporate social and public responsibility, including political contributions • Investor relations | ||||

Health, Safety, Environment and Security Committee | • Oversight of the Company’s programs and procedures to manage and mitigate health, safety, environment and security (“HSES”), operational and weather-related risks • Ensuring that management recognizes and addresses emerging HSES issues and regulations • Ensuring the Company conducts appropriate internal and external HSES auditing programs, assesses the results of such audits and implements corrective action for issues identified in such audits | ||||

We have an insider trading policy governing the purchase, sale and other dispositions of our securities that applies to our directors, officers, employees, other covered persons, and to the company itself (the “Insider Trading Policy”). We believe that our Insider Trading Policy is reasonably designed to promote compliance with insider trading laws, rules and regulations, as well as applicable NYSE listing standards.

2025 PROXY STATEMENT |  | 17 | ||||

Our Insider Trading Policy also prohibits our directors, officers and employees from entering into hedging or monetization transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds, because such transactions may permit a director, officer or employee to continue to own securities obtained through our employee benefit plans or otherwise, but without the full risks and rewards of ownership. When that occurs, the individual may no longer have the same objectives as our other stockholders.

A copy of the Insider Trading Policy can be found in Exhibit 19.1 of the Company’s Form 10-K for the fiscal year ended December 31, 2024.

The Company maintains an enterprise risk management process that is designed to identify, assess, mitigate and monitor the risks that the organization faces. The process is guided by an Enterprise Risk Management Charter, which sets forth the primary goals of the program and is overseen, internally, by a Risk Council that is comprised of members of the executive team, as well as externally through the Audit Committee of the Board. In conducting the program, the Company engages in a series of risk identification workshops in its business units and functions, including finance, legal, environment and sustainability, health and safety, strategy and others. Upon completion of the workshops, the Company develops a listing of the identified risks and risk definitions. Those risks then are evaluated through a risk assessment process in which Company personnel assess the severity, likelihood and existing mitigation effectiveness relating to the identified risks. After compiling the results of the assessment process in 2024, individual risks are assigned to one or more “risk owners” who review the existing mitigation efforts and steps that should be taken to further mitigate the effects of such risks. Those risk owner reviews are then presented to the Audit Committee at its regularly scheduled meetings.

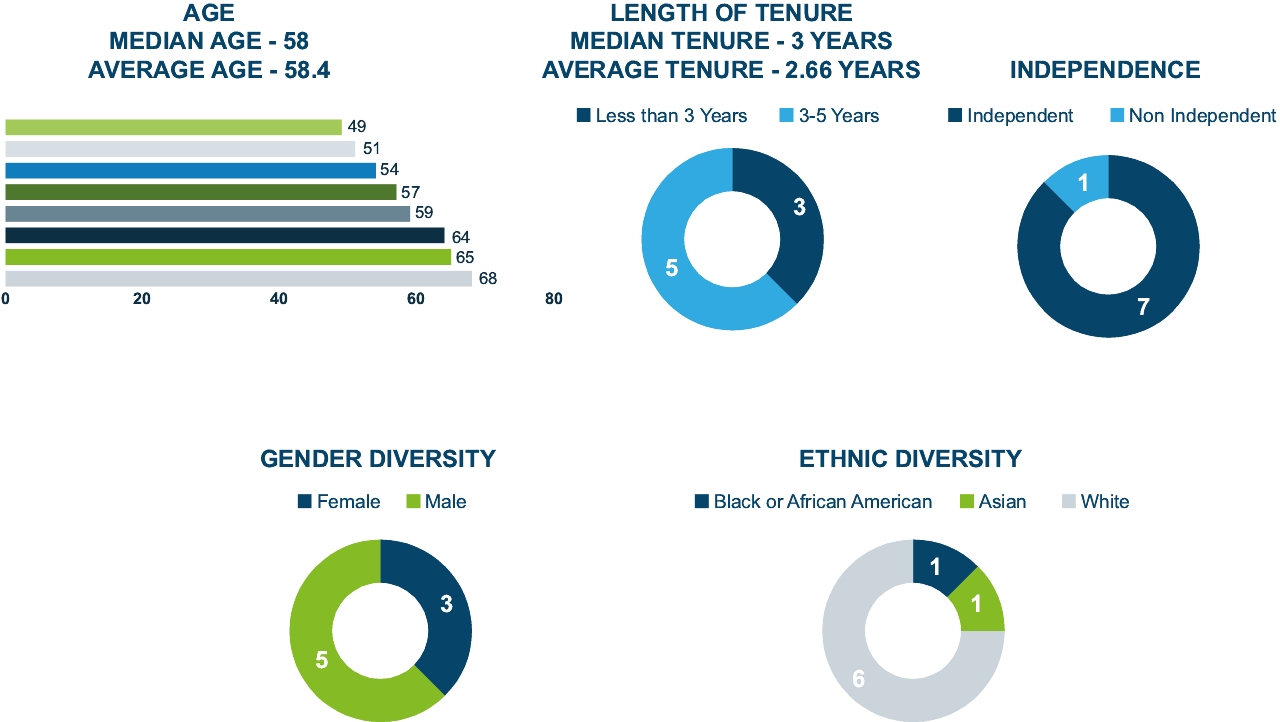

The Board believes it is a priority to engage in thoughtful, deliberate director refreshment that expands diversity in experience and critical perspectives in order to benefit all of Ecovyst’s stakeholders. All our current Board members have joined the Board as directors since 2020.

We seek to have a Board that represents diversity as to experience, gender and ethnicity/race, but we do not have a formal policy with respect to diversity. We also seek a Board that reflects a range of talents, ages, tenures, skills, character and expertise, particularly in the areas of leadership, operations, risk management, accounting and finance, strategic planning and the industries in which we operate, sufficient to provide sound and prudent guidance with respect to our operations and interests.

Our Board currently is comprised of eight members, and we believe their ages, experiences, gender and ethnic diversities and skills collectively bring a broad range of outlooks and talents to their services to the Company. For example, four of our current directors – or 50% of the Board composition – bring gender or racial/ethnic diversity to the Board. Two members of our Board also are armed forces veterans. The illustrations below show the make-up of our current Board of Directors based on age, Board tenure, independence, and gender and racial/ethnic diversity.

18 |  | 2025 PROXY STATEMENT | |||||||

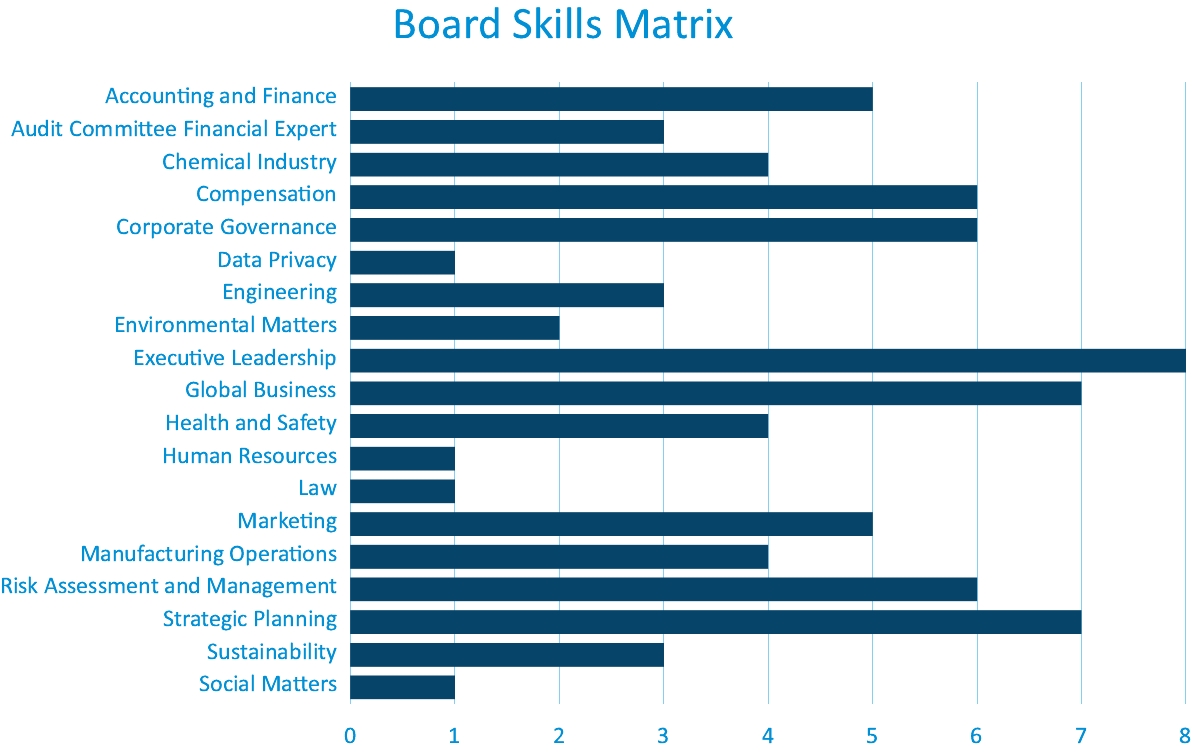

We also strive to recruit and retain qualified directors who bring a diversity of thought and experience to our Board. The chart below shows certain of the various skills and experiences that our Board believes are important to the oversight of the Company and the number of current Board members who bring such skill or experience to the Board.

Criteria and Process of Identifying and Evaluating Candidates for Consideration as a Director Nominee

Under its charter, our Nominating and Corporate Governance Committee is responsible for recommending to the Board candidates to stand for election to the Board at the Company’s annual meeting of stockholders and candidates to fill vacancies on the Board that may occur between annual meetings of stockholders. The Nominating and Corporate Governance Committee may receive suggestions for new directors from a number of sources, including Board members and our Chief Executive Officer, and may also, in its discretion, employ a third-party search firm to assist in identifying candidates for director. The Corporate Governance Guidelines provide that each director should possess the combination of skills, professional experience and diversity of viewpoints necessary to oversee the Company’s business. It is the policy of the Board that directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the Company’s stakeholders. Board members are expected to become and remain informed about the Company, its business and its industry and rigorously prepare for, attend and participate in all Board and applicable committee meetings. The Nominating and Corporate Governance Committee evaluates each individual in the context of the skills, character, diversity and expertise of the Board as a whole, with the objective of recommending directors that can best perpetuate the success of the Company’s business and represent stockholder interests through the exercise of sound judgment using their diversity of experience. In addition, the Nominating and Corporate Governance Committee considers, in light of our business, each director nominee’s experience, qualifications, attributes and skills that are identified in the biographical and other information contained in this Proxy Statement.

Procedures for Recommendation of Director Nominees by Stockholders

The Nominating and Corporate Governance Committee considers properly submitted recommendations for candidates to the Board from stockholders in accordance with our Bylaws. Any stockholder may submit in writing a candidate for consideration for each

20 |  | 2025 PROXY STATEMENT | |||||||

stockholder meeting at which directors are to be elected by no later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the anniversary date of the prior year’s annual meeting, except that if the annual meeting is set for a date that is not within 30 days of such anniversary date, we must receive the notice no later than the close of business on the tenth day following the day on which the date of the annual meeting is first disclosed in a public announcement. Any stockholder recommendations for consideration by the Nominating and Corporate Governance Committee should include the candidate’s name, biographical information and the information required by Section 1.2 of our Bylaws. Recommendations should be sent to c/o Secretary, Ecovyst Inc., 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087. The Nominating and Corporate Governance Committee evaluates candidates for director recommended by stockholders in the same manner as candidates from other sources. The Nominating and Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources.

Under our Corporate Governance Guidelines, our Board may select a Chairperson at any time. Mr. Fogarty has served as our Board Non-Executive Chairman since April 2022. As non-Executive Chairman, Mr. Fogarty has the power to call meetings of the independent directors and to preside over such meetings. The Board believes that utilizing a Non-Executive Chairman and the exercise of key Board oversight responsibilities by independent directors is currently in the best interest of our stockholders.

Since our IPO, we have maintained a classified board structure in which directors are divided into three classes and directors of one class are elected each year to serve a three-year term. The Board believed that this classified board structure promoted continuity and stability of strategy, encouraged a long-term perspective by Company management and facilitated the ability of the Board to focus on creating long-term stockholder value. In 2023, the Board reevaluated the classified board structure and concluded that it would be in the best interests of the Company and its stockholders to propose the Charter Amendment, which the stockholders voted to approve at the 2024 annual meeting of stockholders. Pursuant to the Charter Amendment, annual elections of directors will be phased in beginning at the Annual Meeting, with the declassification process being completed at the 2027 annual meeting of stockholders.

The Chief Executive Officer reviews succession planning and management development with the Board and its applicable committees on an annual basis. This succession planning includes the development of policies and principles for selection of the Chief Executive Officer, including succession in the event of an emergency or retirement.

Our Corporate Governance Guidelines provide that in an uncontested election of directors, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election shall promptly tender his or her resignation following certification of the stockholder vote. The Board shall determine whether or not to accept such resignation within a period of 120 days following the stockholder vote, and will promptly publicly disclose its decision to accept or reject the resignation and the reasons for doing so.

Our Corporate Governance Guidelines provide that a director who is also an employee of the Company shall be deemed to have offered his or her resignation from the Board to the Nominating and Corporate Governance Committee at the same time he or she retires, resigns or is terminated from employment with the Company. In addition, directors who retire or otherwise change from the principal occupation or background association they held when they were originally invited to the Board should provide notice to the Nominating and Corporate Governance Committee or the Board and offer to resign from the Board. The Board does not believe that such directors should necessarily leave the Board, but there should be an opportunity for the Board to review the continued appropriateness of such director’s membership under these circumstances.

2025 PROXY STATEMENT |  | 21 | ||||

The Board also believes that each director should advise the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve as a member on another board of directors. In general, the Board does not have a policy limiting the number of other public company boards of directors upon which a director may sit. However, the Nominating and Corporate Governance Committee shall consider the number of other boards of directors (or comparable governing bodies), particularly with respect to public companies, on which a prospective nominee is a member. Although the Board does not impose a limit on outside directorships, it does recognize the substantial time commitments attendant to membership on the Board and expects that directors devote all such time as is necessary to fulfill their accompanying responsibilities, both in terms of preparation for, and attendance and participation at, meetings.

Pursuant to our Audit Committee charter and the NYSE listing rules, members may serve on no more than three public company audit committees simultaneously without prior review and determination by the Board that such simultaneous service would not impair the ability of such member to effectively serve on the Company’s Audit Committee.

Pursuant to the retirement and tenure policy contained in the Corporate Governance Guidelines, upon reaching the age of 75, a director shall offer to resign from the Board and all committees thereof effective upon the completion of his or her then-current term, and the Nominating and Corporate Governance Committee shall review the continued appropriateness of that director’s membership on the Board under the circumstances and make a recommendation to the full Board as to whether to accept or decline such offer to resign.

In addition, a non-employee director who has served on the Board for 12 consecutive years shall offer to resign from the Board and all committees thereof effective upon the completion of his or her then-current term, and the Nominating and Corporate Governance Committee shall review the continued appropriateness of that non-employee director’s membership on the Board under the circumstances and make a recommendation to the full Board as to whether to accept or decline such offer to resign. The 12 year service period shall be calculated beginning on the date the non-employee director first joined the Board (whether as a result of election by the Board to fill a director vacancy or election by the stockholders) or, if applicable, the date of the Company’s IPO, whichever is later.

Our Board of Directors adopted a Code of Ethics that applies to all of certain senior executive and financial officers, including our Chief Executive Officer and Chief Financial Officer. The full text of our Code of Ethics is available by clicking on “Management & Governance” in the Investors section of our website, www.ecovyst.com.” We intend to post any amendment to, or a waiver from, a provision of our Code of Ethics that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and that relates to any element of the Code of Ethics definition enumerated in paragraph (b) of Item 406 of Regulation S-K by posting such on the same website.

Stockholders and other interested parties may communicate directly with the Board, the non-employee directors or the independent directors as a group, or specified individual directors by writing to such individual or group c/o Secretary, Ecovyst Inc., 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087. The Secretary will forward such communications to the relevant group or individual at or prior to the next meeting of the Board.

The current versions of our Corporate Governance Guidelines, Code of Conduct, Code of Ethics for Senior Executive and Financial Officers and charters for our Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Health, Safety, Environment and Security Committee are available by clicking on “Management & Governance” in the Investors section of our website, www.ecovyst.com. These materials are also available in print free of charge to stockholders, upon written request to c/o Secretary, Ecovyst Inc., 600 Lee Road, Suite 200 Wayne, Pennsylvania 19087.

22 |  | 2025 PROXY STATEMENT | |||||||

Sustainability is intertwined with our daily business and is reinforced through our strategy and values. We strive to create sustainable products that are safe for the environment, and to reduce waste and increase efficiencies for our customers and stakeholders. We believe that our products contribute to lower emissions and cleaner air, advance the global transition to clean energy, support the circular plastics economy and ensure clean, purified drinking water. We are committed to creating environmentally responsible products that we believe make a difference in people’s daily lives and for our planet.

While offering products and services that help our customers to advance their own sustainability goals, we also work to advance our commitment to maintain sound environmental, social and governance (“ESG”) practices, policies and procedures. For example, we:

• | Were awarded a 2024 Platinum Sustainability rating from EcoVadis, a third-party sustainability evaluation company. The Platinum rating from EcoVadis placed us among the top 1% (99th percentile) of all companies assessed by EcoVadis over the prior twelve-month period; |

• | Maintained an executive level position of Vice President – Environment and Sustainability that reports directly to our Chief Executive Officer; |

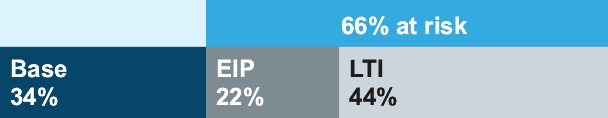

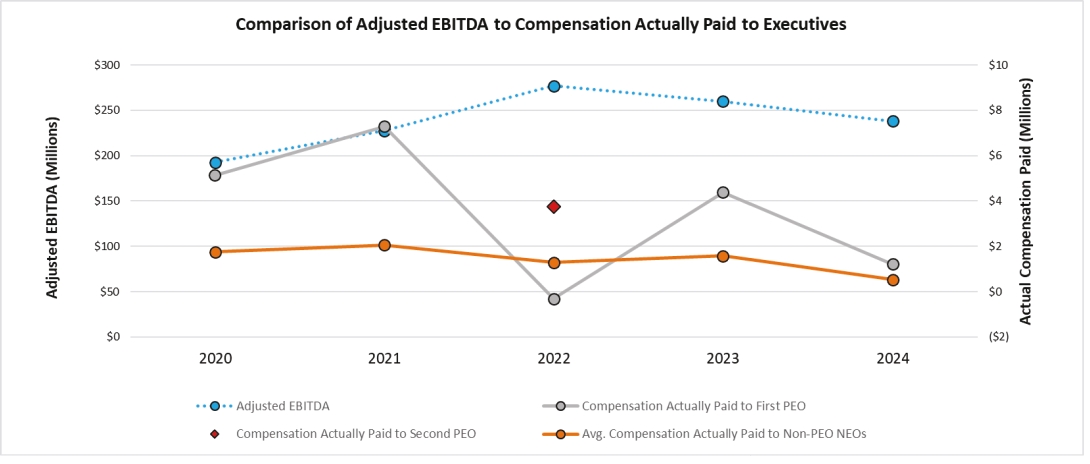

• | Under the leadership of our Global Director of Health, Safety and Process Safety Management, instituted additional health, safety and process safety programs, as well as continued our company-wide employee health and wellness program that covers both physical and mental health services; |