INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Although we encourage you to read this Proxy Statement in its entirety, we include this Q&A section to provide some background information and brief answers to several questions you might have about the Annual Meeting.

Why are we providing these materials?

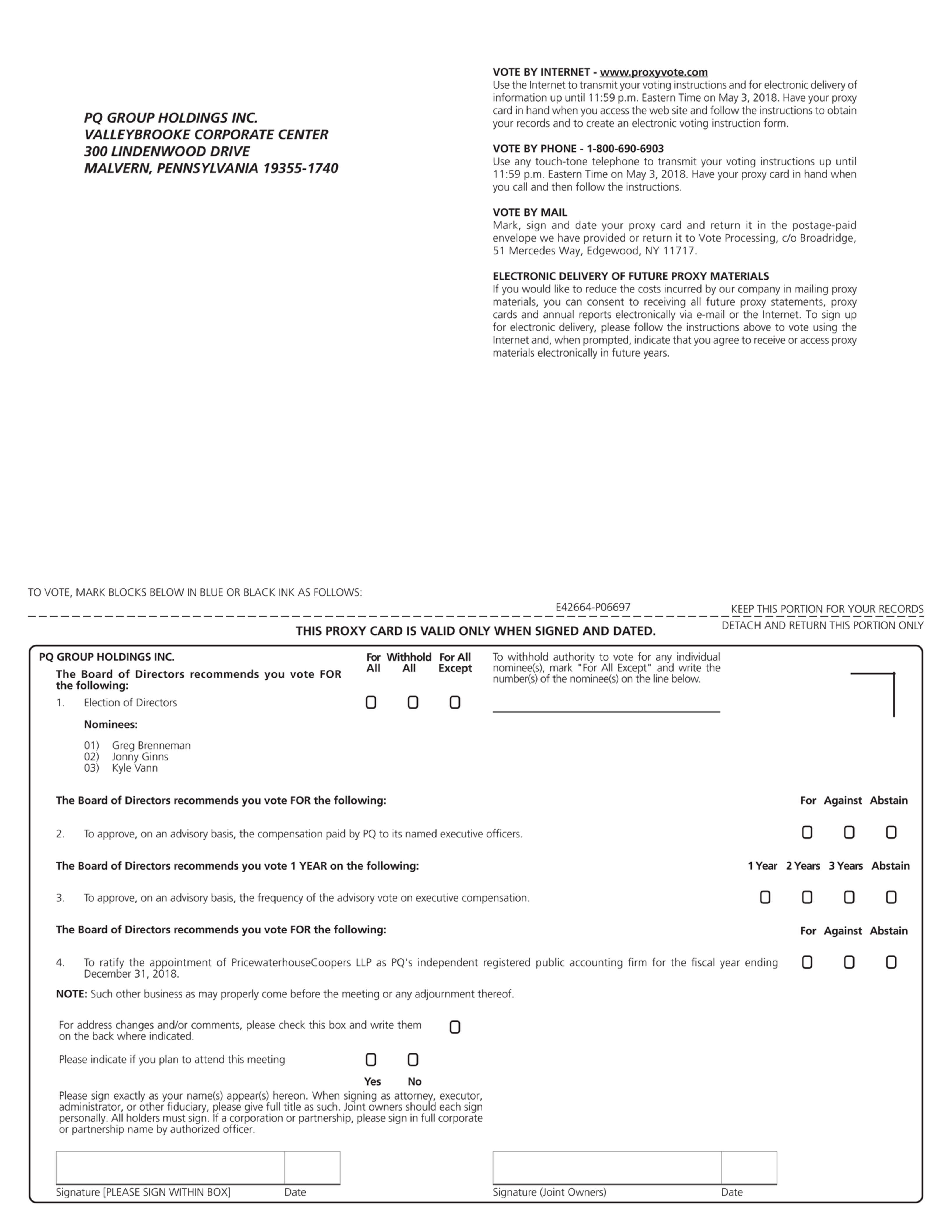

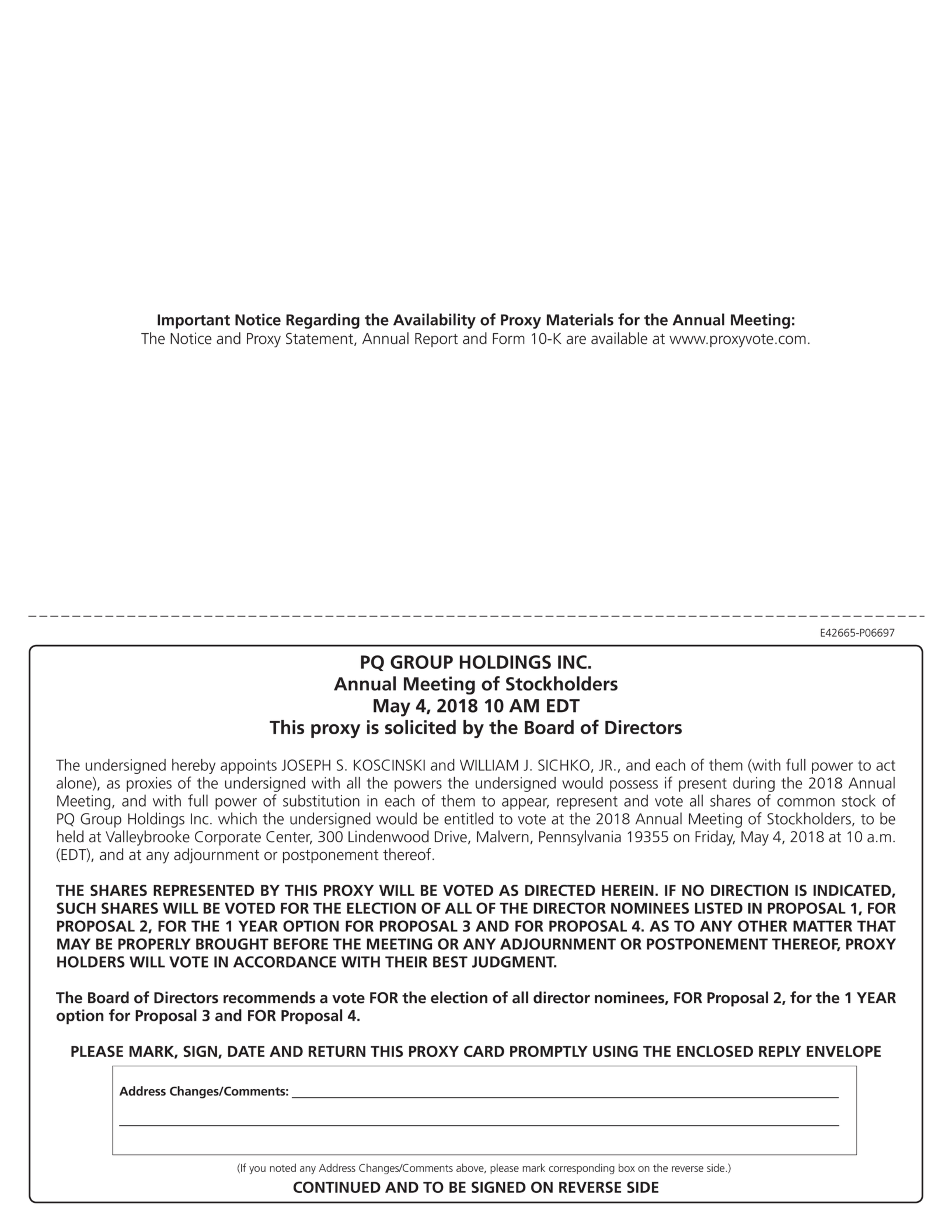

Our Board is providing these materials to you in connection with our Annual Meeting, which will take place on May 4, 2018 at our offices at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 at 10:00 a.m. (Eastern Time). Stockholders are invited to participate in the Annual Meeting and are requested to vote on the proposals described herein.

What information is contained in this Proxy Statement?

This Proxy Statement contains information relating to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our directors and most highly paid officers, and other required information.

What proposals will be voted on at the Annual Meeting?

There are four proposals scheduled to be voted on at the Annual Meeting:

|

• |

the election of the three Class I director nominees specifically named in this Proxy Statement, each to serve for a term of three years; |

|

• |

an advisory vote on the say-on-pay proposal; |

|

• |

an advisory vote on the frequency of the say-on-pay proposal in the future; and |

|

• |

the ratification of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2018. |

We will also consider other business properly brought before the Annual Meeting.

What shares can I vote?

You may vote all shares of Common Stock that you owned as of the close of business on the record date, March 29, 2018. You may cast one vote per share, including shares (i) held directly in your name as the stockholder of record and (ii) held for you as the beneficial owner through a broker, bank, or other nominee. The proxy card will indicate the number of shares that you are entitled to vote.

As of March 29, 2018, there were 135,240,866 shares of Common Stock outstanding, all of which are entitled to be voted at the Annual Meeting.

A list of stockholders will be available at our headquarters at Valleybrooke Corporate Center, 300 Lindenwood Drive, Malvern, Pennsylvania 19355 for a period of at least ten days prior to the Annual Meeting and at the Annual Meeting for examination by any stockholder.

What is the difference between being a stockholder of record and a beneficial owner of shares held in street name?

Many of our stockholders hold their shares through brokers, banks, or other nominees, rather than directly in their own names. As summarized below, there are some differences between being a stockholder of record and a beneficial owner of shares held in street name.

Stockholder of record: If your shares are registered directly in your name with PQ’s transfer agent, American Stock Transfer and Trust Company, LLC, you are the stockholder of record with respect to those shares and the proxy materials were sent directly to you. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals named on the proxy card and to vote at the Annual Meeting.